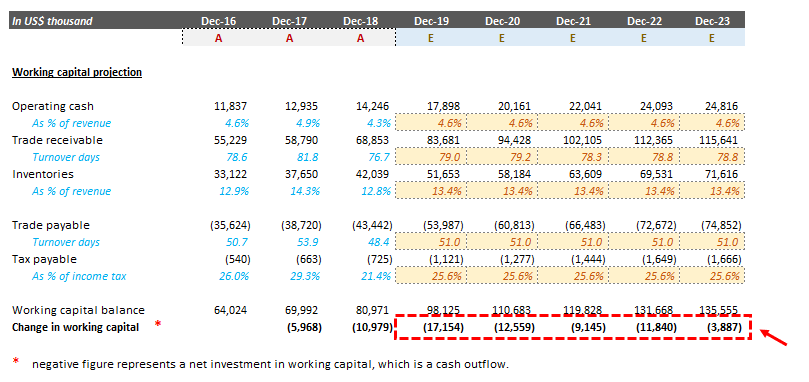

change in working capital formula dcf

Since the change in working capital is positive you add it back to Free Cash Flow. In the case of a bond the discount rate is the rate of interest.

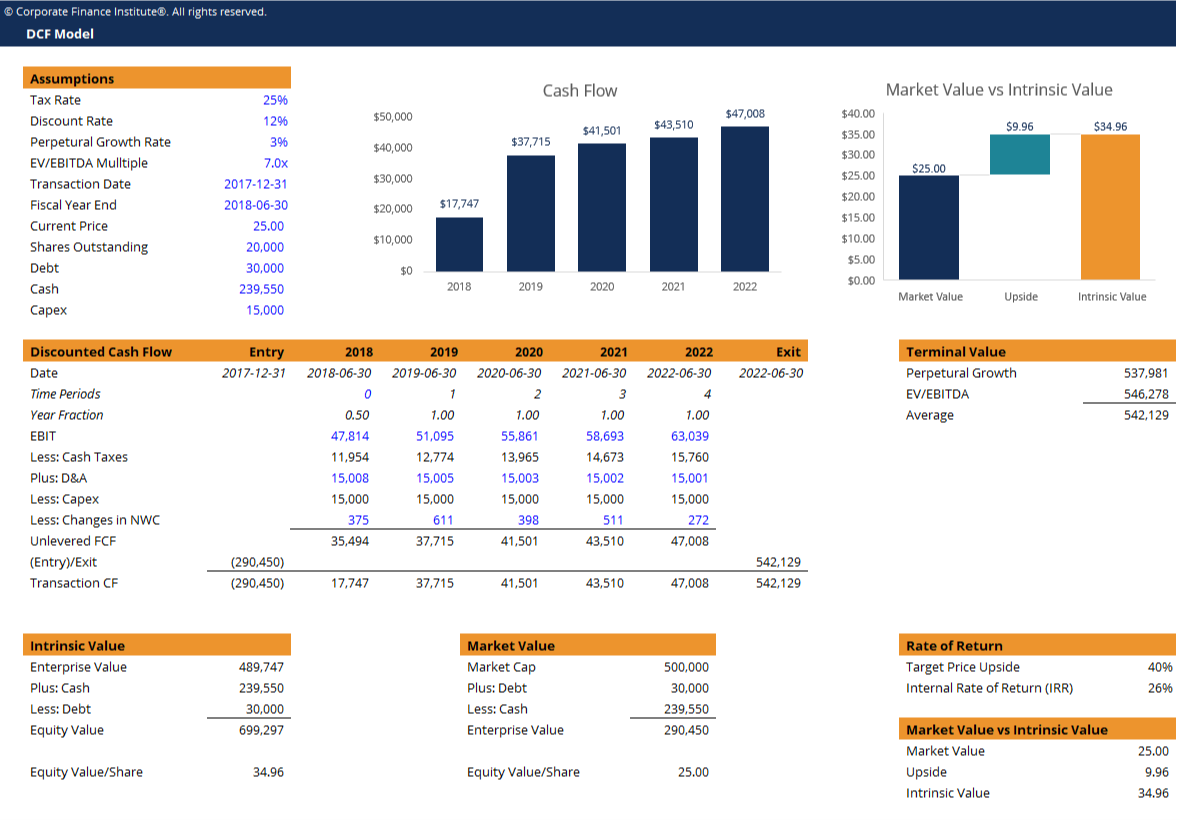

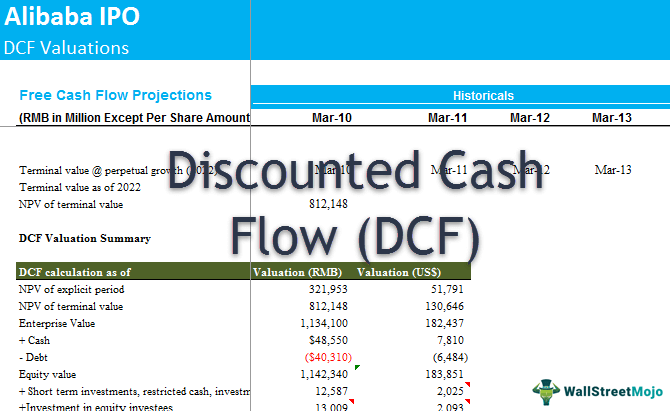

Dcf Model Full Guide Excel Templates And Video Tutorial

Working Capital Formula in Excel With Excel Template Here we will do the same example of the Working Capital formula in Excel.

. Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash. A company can increase its working capital by selling more of its products. If the change in NWC is positive the company collects and holds onto cash earlier.

You can easily calculate the Working Capital using the Formula in the template provided. Change in Net Working Capital Formula Calculator. Below is an example balance sheet used to calculate working capital.

Denotes the final or additional years. WACC includes the average cost of a firms working capital minus taxes. Change in Net Working Capital Formula.

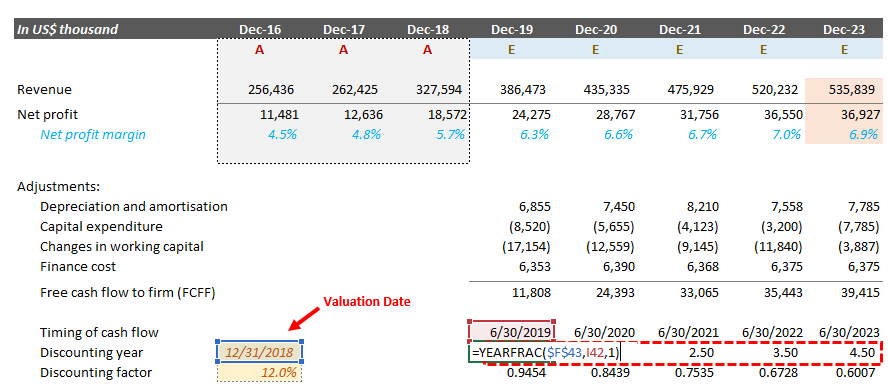

For businesses it is the weighted average cost of capital WACC. Net Working capital in very simple terms is basically the amount of fund which a business needed to run its operations on a daily basis. It is the rate which investors expect to receive on average from a firm for financing its assets.

In other words it is the measure of liquidity of business and its ability to meet short term expenses. The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. It is very easy and simple.

Invested Capital Fixed Assets Net Working Capital NWC There are two routes to think about invested capital but either approach is ultimately identical to the other due to double-entry accounting. Therefore Microsofts TTM owner earnings come out to be. Example calculation with the working capital formula.

What is Change in NWC. 18819105991263-13102 19192 34245. However if the change in NWC is negative the business model of the company might require.

In contrast in. In Scenario A the change in invested capital was 25m more for an increase of 5m in NOPAT. Change in Net.

If the price per unit of the product is 1000 and the cost per unit in inventory is 600 then the companys working capital will increase by. You need to provide the two inputs ie. Current Assets and Current Liabilities.

Discounted Cash Flow Analysis Veristrat Llc What S Your Valuation

Discounted Cash Flow Dcf Sutton Capital

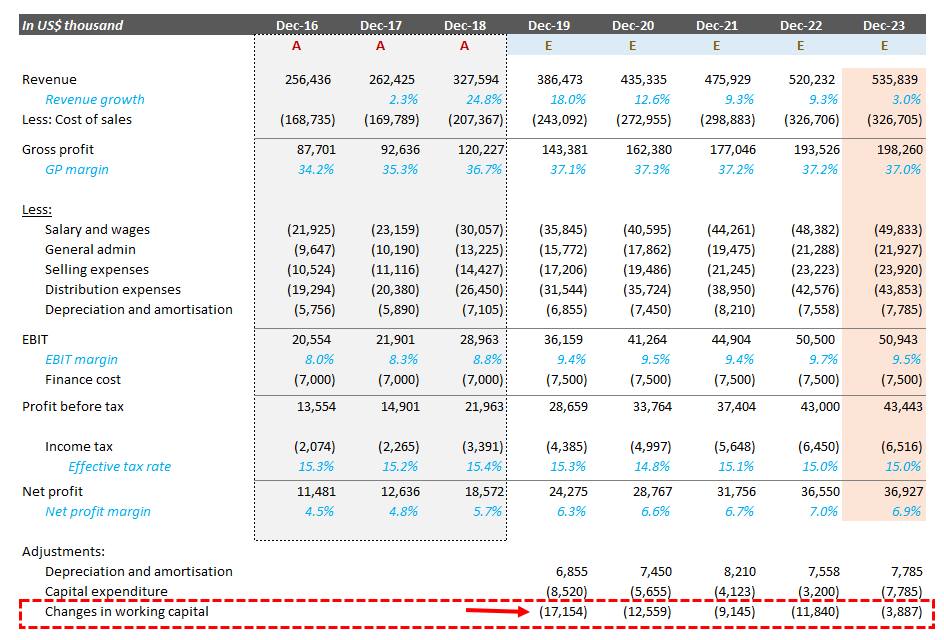

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

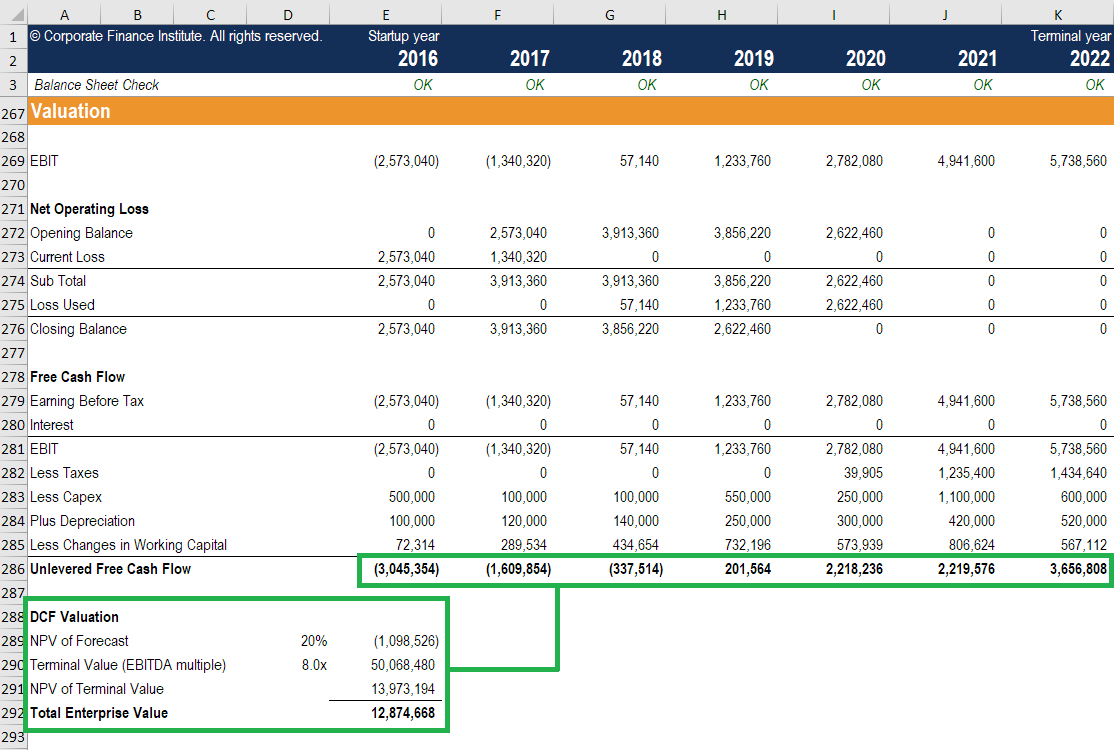

Dcf Model Tutorial With Free Excel Business Valuation Net

Dcf Model Training The Ultimate Free Guide To Dcf Models

Discounted Cash Flow Analysis Street Of Walls

Change In Net Working Capital Nwc Formula And Calculator Excel Template

/dotdash_Final_Top_3_Pitfalls_Of_Discounted_Cash_Flow_Analysis_Feb_2020-01-a5c2306a3b294872a505aa63bd2cea7e.jpg)

Top 3 Pitfalls Of Discounted Cash Flow Analysis

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Change In Working Capital Video Tutorial W Excel Download

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

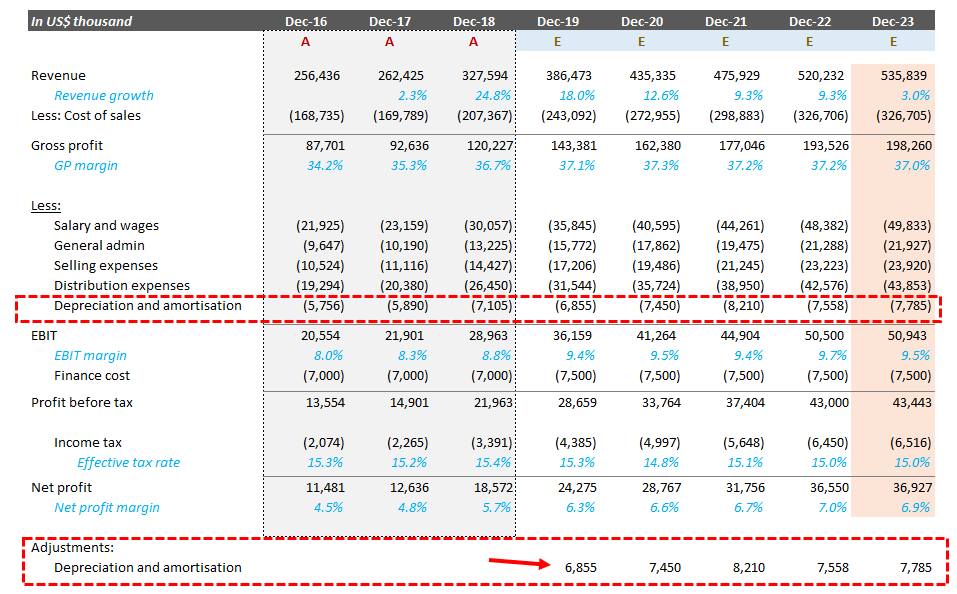

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator Excel Template